Is Liposuction Covered by Health Insurance?

This is a very common and practical question I receive from my patients in Jaipur. The simple answer is: generally, no, but in some specific cases, yes.

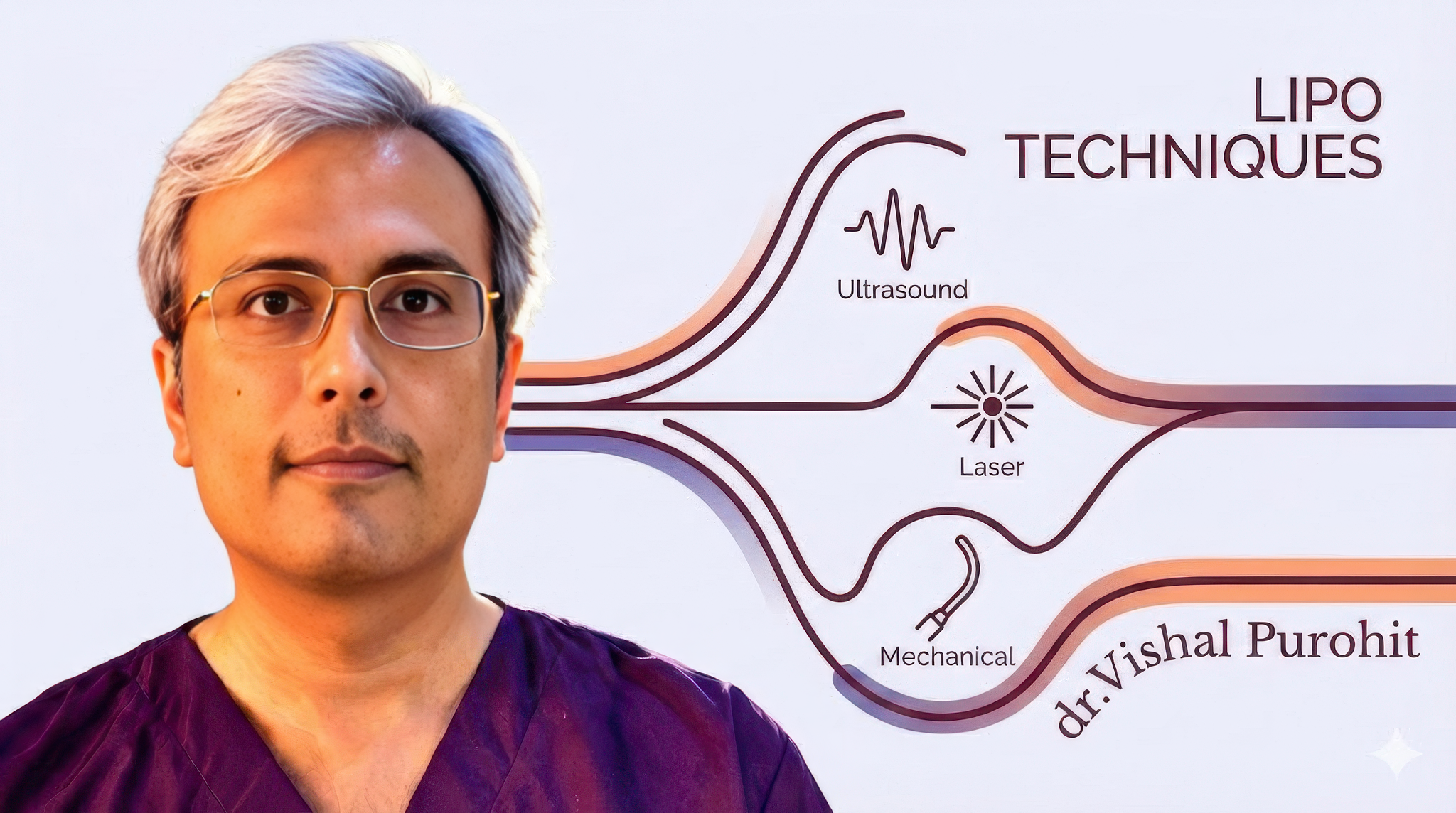

The key to understanding this is the classification of the procedure. Health insurance plans differentiate between “cosmetic” (aesthetic) surgery and “reconstructive” (medically necessary) surgery.

Cosmetic Classification: Why Liposuction Is Usually Not Covered

For the vast majority of patients, liposuction is an elective cosmetic procedure. Its goal is to enhance your appearance and body contour by removing unwanted fat.

Because it is classified as cosmetic and not medically essential, standard health insurance plans in India do not cover the cost of cosmetic liposuction.

This means that if you are having liposuction for aesthetic body sculpting, you will be responsible for the full liposuction cost in Jaipur. This includes the surgeon’s fee, anaesthesia, hospital charges, and post-operative compression garments.

Medical Necessity: The Exception for Coverage

However, health insurance may provide coverage when liposuction is deemed medically necessary to treat a functional health condition. In these scenarios, the procedure is re-classified as “reconstructive.”

This leads to the next logical question: When is liposuction medically necessary?

Conditions That May Qualify for Coverage

Coverage is possible only when we can provide detailed documentation of a functional impairment. Conditions that may qualify include:

- Lipedema: A chronic and often painful condition involving the abnormal accumulation of fat, typically in the legs and bottom.

- Lymphedema: The treatment of chronic swelling (oedema) caused by excess lymph fluid collecting in tissues.

- Lipomas: The removal of benign (non-cancerous) fatty tumours, especially if they are large, painful, or in a functionally sensitive area.

- Post-Massive Weight Loss: In some cases, to remove excess skin and tissue after significant weight loss.

The Process: How to Seek Reimbursement

Securing insurance approval for medically necessary liposuction demands meticulous documentation and is often a complex process.

- Pre-authorisation: You must obtain pre-authorisation from your insurer before the surgery.

- Rigorous Documentation: As your surgeon, I must submit detailed medical records, photographs, and clinical evidence demonstrating the functional medical necessity of the procedure.

- The Appeal Process: It is very common for these claims to be initially denied. However, many of these denials can be successfully won upon appeal, provided the documentation fully supports the criteria for reconstructive surgery.

My role as your liposuction surgeon in Jaipur is to provide an honest assessment of your condition and, if it is medically necessary, to supply the correct and thorough documentation to support your claim. This administrative diligence is part of the comprehensive liposuction safety protocols my clinic follows.

Clarify Your Investment

Understanding whether your procedure is cosmetic or medical is the first step in planning your financial investment. For most, liposuction is a personal investment in their confidence and body image.

If you are a good candidate for liposuction, the procedure can be a transformative and worthwhile investment, whether it is covered by insurance or not.

Contact my clinic to schedule a consultation. We can discuss your goals and help you understand the classification of your specific procedure.

- 📞 Call: 7718183535

- 💬 WhatsApp: 7718183535

- 📍 Visit: Kalpana Aesthetics, 2nd Floor, Jaipur Hospital, Mahaveer Nagar, Tonk Road, Jaipur

Disclaimer: This website provides general information and discussions about medical procedures. The information and other content provided on this website, or in any linked materials, are not intended and should not be construed as medical advice, nor is the information a substitute for professional medical expertise or treatment. All results are individual and may vary. Please consult Dr. Vishal Purohit for a personalised consultation. Insurance coverage is subject to the terms and conditions of your specific policy and is not guaranteed.